Edit

Fill out

Sign

Export

What IRS forms are needed for a rental property?

The Internal Revenue Service (IRS) requires that all landlords file specific tax forms in order to deduct expenses associated with their rental property. When it comes to rental property, the IRS has a few different forms that may be required. Specifically, Form 1040, Schedule E, Form 1065, and Form 1120S.

Form 1040 is the standard individual tax return form and is used to report income from all sources, including rental property. Schedule E is used to report income and expenses from rental property, and Form 1065 is used for partnerships and LLCs. Form 1120S is used for S corporations.

In general, you will need to file Form 1040 and Schedule E if you own and operate a rental property. If you are a partner in a partnership or LLC that owns and operates a rental property, you will need to file Form 1065. And if you are a shareholder in an S corporation that owns and operates a rental property, you will need to file Form 1120S.

The specific forms and documents that you will need to file can vary depending on the type of rental property you have, the location of the property, and the type of ownership. For example, if you are renting out a room in your primary residence, you will likely only need to file Form 1040. But if you are renting out a vacation home or an investment property, you will need to file additional forms and documents.

The best way to determine which forms and documents you need to file is to speak with a tax professional or the IRS. They can help you determine which forms and documents are required for your specific situation.

Form 1040 is the standard individual tax return form and is used to report income from all sources, including rental property. Schedule E is used to report income and expenses from rental property, and Form 1065 is used for partnerships and LLCs. Form 1120S is used for S corporations.

In general, you will need to file Form 1040 and Schedule E if you own and operate a rental property. If you are a partner in a partnership or LLC that owns and operates a rental property, you will need to file Form 1065. And if you are a shareholder in an S corporation that owns and operates a rental property, you will need to file Form 1120S.

The specific forms and documents that you will need to file can vary depending on the type of rental property you have, the location of the property, and the type of ownership. For example, if you are renting out a room in your primary residence, you will likely only need to file Form 1040. But if you are renting out a vacation home or an investment property, you will need to file additional forms and documents.

The best way to determine which forms and documents you need to file is to speak with a tax professional or the IRS. They can help you determine which forms and documents are required for your specific situation.

How do I Write a General Rental Application?

A rental application is a document used by landlords to screen potential tenants. The application gathers information about the applicant's credit history, employment history, and rental history. The landlord uses this information to determine if the applicant is a good fit for the rental property.

The rental application should be a detailed document that is easy to read and understand. The form should be divided into sections so that the landlord can easily find the information they are looking for. The sections should include:

1. Personal Information: This section should include the applicant's name, address, phone number, and email address. The landlord will use this information to run a background check.

2. Employment History: This section should include the applicant's current employer, job title, salary, and start date. The landlord should also include information about the applicant's previous employment.

3. Credit History: This section should include the applicant's credit score, credit history, and any bankruptcies or foreclosures.

4. Rental History: This section should include the applicant's current landlord, rental address, and start date. The landlord should also include information about the applicant's previous rental history.

5. References: This section should include the names and contact information of the applicant's personal and professional references.

Once you have completed all of the sections, you will need to sign and date the rental application. Make sure to read the entire form carefully before you sign it, as you may be held responsible for any inaccurate information that you provide.

It is important to take your time when filling out a rental application. Make sure that all of the information that you provide is accurate and complete. If you have any questions, be sure to ask the landlord before you submit the form.

The landlord should require all applicants to submit a completed rental application. The landlord should review all of the information on the application before making a decision. The landlord should contact the applicant's references to verify the information on the application.

1. Personal Information: This section should include the applicant's name, address, phone number, and email address. The landlord will use this information to run a background check.

2. Employment History: This section should include the applicant's current employer, job title, salary, and start date. The landlord should also include information about the applicant's previous employment.

3. Credit History: This section should include the applicant's credit score, credit history, and any bankruptcies or foreclosures.

4. Rental History: This section should include the applicant's current landlord, rental address, and start date. The landlord should also include information about the applicant's previous rental history.

5. References: This section should include the names and contact information of the applicant's personal and professional references.

Once you have completed all of the sections, you will need to sign and date the rental application. Make sure to read the entire form carefully before you sign it, as you may be held responsible for any inaccurate information that you provide.

It is important to take your time when filling out a rental application. Make sure that all of the information that you provide is accurate and complete. If you have any questions, be sure to ask the landlord before you submit the form.

The landlord should require all applicants to submit a completed rental application. The landlord should review all of the information on the application before making a decision. The landlord should contact the applicant's references to verify the information on the application.

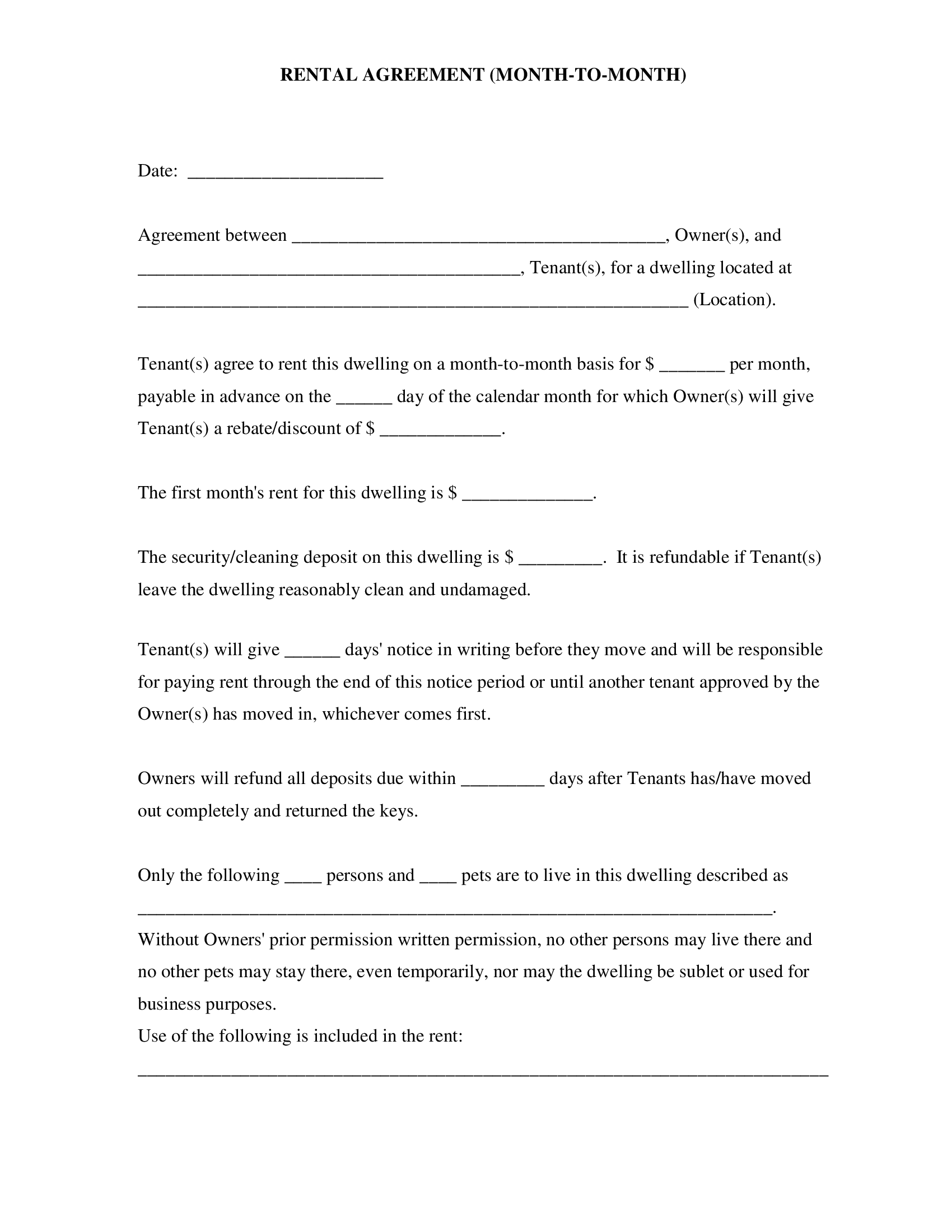

Where can I get a rental lease form?

There are a number of places where you can get a rental lease form. The most obvious place to start is with the Internal Revenue Service (IRS). They have a number of forms that you can use for your rental property. However, they also have a number of restrictions that you need to be aware of. For example, you can only use their forms if you are renting out property that is used for business purposes.

Another option is to use a service like PDFLiner. This service allows you to free-fill out a form and then print it out. This can be a good option if you need a lease form for personal property.

Finally, you can always try to find a lease form online. There are a number of websites that offer these forms for free. However, you need to be careful when using these forms. Make sure that you read the terms and conditions carefully before you use any of these forms.

Another option is to use a service like PDFLiner. This service allows you to free-fill out a form and then print it out. This can be a good option if you need a lease form for personal property.

Finally, you can always try to find a lease form online. There are a number of websites that offer these forms for free. However, you need to be careful when using these forms. Make sure that you read the terms and conditions carefully before you use any of these forms.

FAQ

You can find more information on how to fill in and file the paper in this section.

What is the difference between a rent agreement and a lease agreement?

There is a big difference between a rent agreement and a lease agreement. A rent agreement is a contract between a tenant and a landlord that outlines the terms of the tenancy, including the rent amount and the length of the tenancy. A lease agreement is a much more detailed contract that outlines the terms of the tenancy, including the rent amount, the length of the tenancy, and the specific rights and responsibilities of the tenant and landlord.

Who prepares the rental agreement?

The property owner or manager typically prepares the rental agreement.

Is a verbal rental agreement legally binding?

A verbal rental agreement can be legally binding, but it is generally not recommended as it can be difficult to prove the terms of the agreement in court if there is a dispute.

Can the landlord change the rules after signing the rental agreement?

Yes, the landlord can change the rules after signing the rental agreement. However, the landlord must give the tenant reasonable notice of any changes and the tenant must agree to the changes in writing.

Related Content - Rental Agreements

Customer documents and information therein are encrypted and accessible only by the customer. We also encrypt…

Customer documents and information therein are encrypted and accessible only by the customer. We also encrypt…

Customer documents and information therein are encrypted and accessible only by the customer. We also encrypt…

Fillable online w9 201...

Customer documents and information therein are encrypted and accessible only by the customer. We also en…

Fillable online w9 201...

Customer documents and information therein are encrypted and accessible only by the customer. We also en…

Fillable online w9 201...

Customer documents and information therein are encrypted and accessible only by the customer. We also en…